Opening a commercial register in Dubai is a crucial step for those wishing to start a business in the vibrant and thriving emirate of Dubai. Opening the commercial register provides the opportunity for individuals and companies to conduct business legitimately and reliably in the local and global Dubai market. This move comes with a set of benefits and advantages that enhance the chances of success and expansion of the business.

Opening a commercial register in Dubai requires following clear and specific procedures, including submitting the required documents and complying with local conditions and regulations. Applicants to open a commercial register seek to obtain the necessary licenses and permits and comply with applicable government laws and regulations.

By opening the commercial registry in Dubai, companies and individuals can benefit from the advanced infrastructure and support services provided by the local government and relevant authorities, which contributes to facilitating business operations and increasing efficiency and effectiveness.

In addition, opening a commercial register in Dubai provides the opportunity to access the dynamic and global local market, expand the business and increase business partnerships and business opportunities.

In this way, opening a commercial register in Dubai is an essential and vital step for everyone who seeks success and excellence in the business world, while providing the appropriate environment for innovation, growth and sustainable development in the local and global commercial market.

جدول المحتوى

ToggleWhat is the commercial register in Dubai?

The Dubai Commercial Register is the official register that contains information related to companies and businesses established in the Emirate of Dubai in the United Arab Emirates. This registry is managed by the Dubai Trade and Industry Authority (Dubai Department of Economic Development – DED).

Dubai trade license is one of the main elements in the trade registry. If you want to set up a business in Dubai, obtaining a business license is an essential step. A trade license includes an official permit granted to a company or individual to conduct a specific business activity in Dubai. The types of commercial licenses in Dubai vary according to the commercial activity to be practiced, such as general commercial companies, limited commercial companies, specialized companies, and free companies.

When applying for a business license in Dubai, applicants are required to submit a set of required documents and information. These may include basic information about the company or individual, such as the name of the proposed company, type of business, proposed address, details of shareholders or owners, and registered capital. This information is reviewed and processed by the Dubai Trade and Industry Authority to verify its accuracy and compliance with applicable laws and regulations.

Dubai Trade Registry plays an important role in regulating businesses and enhancing transparency and credibility in the commercial market. It also contributes to providing a suitable business environment for entrepreneurs and investors, where they can access reliable and updated information about registered companies and active traders in Dubai. Thanks to this registry, government agencies, investors and customers can verify and verify information and identify licensed and reliable business entities in Dubai.

Ultimately, the Dubai Trade Registry serves as an important tool to facilitate business and promote economic development in the region. By providing the necessary information and support to companies and entrepreneurs, the Dubai Trade Register contributes to enhancing confidence in the market and attracting more investments and business opportunities to the city.

How to open a commercial register in Dubai

How to open a commercial register in Dubai requires following some formal steps and procedures. Here are general ways to open a commercial register in Dubai:

- Determine the business activity: Specify the type of business activity you wish to practice, as it must fit the classifications available in the trade register.

- Choosing a company name: Choose an appropriate name for your company and make sure it is not similar to the names of other companies registered in the trade register.

- Prepare the required documents: Prepare the required documents, which may include a passport, a photograph, a residence permit, and a business location document.

- Visit the Department of Economic Development (DED): Visit the Department of Economic Development in the Emirate of Dubai to submit the required documents and information.

- Submit a registration application: Submit a commercial registry registration application, and fill out the official forms with the required information.

- Trade name check: A check will be conducted to ensure the availability of the chosen trade name.

- Payment of fees: Pay the fees related to registering the commercial registry. This fee must be paid to complete the registration process.

- Receiving the commercial license: After approving the application, you will receive a commercial license proving the legality of your business.

- Update information: Be sure to update necessary information periodically, such as changes in responsibilities or address.

Fees for registering a commercial registry in Dubai

Fees related to registering a commercial registry in Dubai vary depending on several factors, such as the type of business activity, the type of company, the location of the company, and the legal category of the company. Here are some points that can affect the cost of registering a commercial registry in Dubai:

- Company Type: Fees vary between sole proprietorships, LLCs, and other companies.

- Type of business: There can be differences in fees based on the type of business the company will be conducting.

- Location: A company’s location in Dubai can affect fees, especially if it is in a free zone or special economic development zone.

- Capital: The amount of capital registered by the company may depend on the fees required.

- Legal category: Fees are different for local companies, branches and foreign companies.

- Legal consultations and services: Fees may also include the costs of legal consultations and services supporting the registration process.

- Government fees: include government fees imposed by the competent authorities in Dubai.

Necessary documents to register a commercial registry in Dubai

The documents required to register a commercial registry in Dubai vary according to the type of company and business activity. However, here is a general list of documents that may be necessary:

- Copy of passport: Copy of passport for shareholders and directors.

- Personal photos: Recent personal photos of shareholders and directors.

- Residence license: A copy of the residence permit for shareholders and directors.

- Copy of visa: A copy of the visa for shareholders and managers.

- Business Plan: A detailed business plan explaining the business activity planned to be implemented.

- Lease Contract or Venue License: A copy of the lease contract or license of the place where the business will be conducted.

- Company Registration Form: Company registration form filled with company and shareholder information.

- Bank letter: A letter from the bank showing the deposit of capital in the company’s account.

- Legal authorization (if there is a legal representative): If there is a legal representative, a legal authorization is required.

- Commercial advertising permit: Submitting a commercial advertising permit to the competent authorities.

- Partner documents (if the company is a partnership): If the company is a partnership, you may need documents defining the partners’ roles and rights.

- Additional documents as needed: Local authorities may request additional documents depending on the business activity and current legislation.

Tax obligations after registering a commercial registry in Dubai

After registering a commercial registry in Dubai, companies must comply with local tax controls. These obligations usually include liability for value added tax (VAT), income tax if the organization is bound by it, in addition to government fees and periodic financial reports. These obligations form an essential part of the financial and tax management process for any business company in Dubai, and they are:

- Value Added Tax (VAT): The UAE has started imposing a 5% VAT on goods and services. Companies registered for VAT must collect this tax from customers and submit it to the Federal Tax Authority.

- Excise tax: Excise tax is imposed on some luxury goods such as tobacco, alcoholic beverages, and energy. The concerned companies submit the necessary tax returns, collect the taxes, and submit them to the Federal Tax Authority.

- Estimated obligations: Companies must adhere to the estimate periodically and submit the required tax reports to the Federal Tax Authority.

- Consider legal changes: Business owners must consider any changes in tax laws and adhere to legal updates.

How to renew a commercial registration in Dubai?

To renew a commercial registration in Dubai, you can follow the following steps:

- Ensure eligibility for renewal: Before starting the renewal process, ensure that the company is eligible for renewal and that all necessary conditions are met, such as payment of due fees and compliance with legal instructions.

- Gather necessary documents: Check the documents required for the renewal process, which may include the company number, company contact information, and current commercial registration number.

- Submitting a renewal application: The renewal application can usually be submitted online through your electronic account on the website of the Department of Economy in Dubai or the entity responsible for managing commerce. The application can also be submitted in person if necessary.

- Payment of fees: You must pay the fees prescribed for the renewal process. Make sure to pay the fees in the specified manner and obtain the payment receipt as proof.

- Application processing: After submitting the application and paying the fees, the application will be processed by the relevant authority. This process can take a few days to weeks, depending on the procedures of the responsible party.

- Receipt of Renewal: Once the application is successfully processed, you will receive a Commercial Registry Renewal Certificate or similar document. Ensure that the document is received and verified for its accuracy and completeness.

By following these steps, you may be able to renew a commercial registration in Dubai successfully and by taking into account all the required legal and administrative procedures.

Possible penalties in case of non-compliance with laws related to the trade register?

Failure to comply with the laws relating to Dubai’s trade registry can result in serious legal consequences and penalties, and these consequences are an essential part of the oversight and regulatory framework in the international commercial environment. Possible penalties in the event of non-compliance with the laws relating to the Dubai Trade Registry include:

- Late penalties: Financial penalties may be imposed if taxes are not paid on time.

- Financial Penalties: Additional financial penalties may be imposed when tax violations are discovered.

- Deregistration: In the event of repeated and serious non-compliance with tax laws, a company can be deregistered.

- Legal accountability: The company may be legally pursued in the event of major transgressions or serious violations of tax laws.

- Loss of business rights: Failure to comply may cause the company to lose its rights to operate and deal with the government.

To avoid these penalties, it is advisable to cooperate with tax and accounting professionals to ensure effective compliance with laws and timely filing of tax declarations and reports.

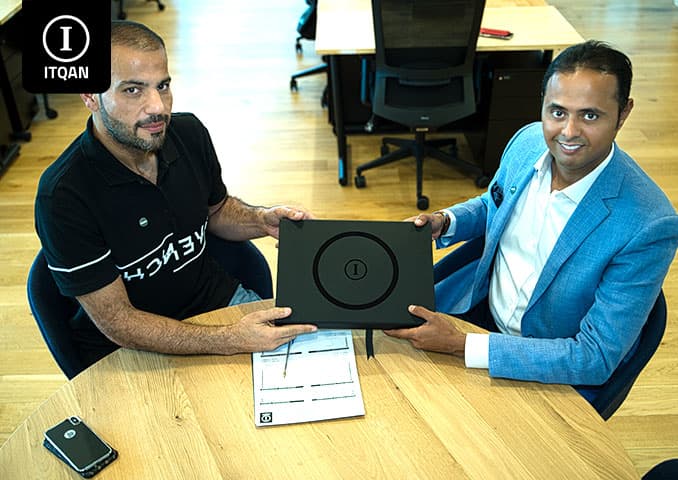

In conclusion, opening a commercial register in Dubai represents an important step towards building a successful and prosperous business in the vibrant emirate of Dubai. In cooperation with Itqan Company, investors can benefit from support and assistance to facilitate the process of opening the commercial registry and start their business adventure with confidence.

Itqan Company provides expertise and specialized services to assist clients in all the steps necessary to open a commercial register in Dubai, starting from preparing the necessary documents and submitting them to the competent authorities, all the way to guiding clients through the legal and administrative procedures.

In short, opening a commercial registry in Dubai represents a gateway for investors to enter the dynamic business market in the UAE, and benefit from the available economic and commercial opportunities. With Itqan’s support, investors can overcome challenges and achieve success in their entrepreneurial journey in the business world in Dubai.

Frequently asked questions about how to open a commercial register in Dubai

What are the basic steps to open a commercial register in Dubai?

- You must first choose the type of business you want to engage in.

- Determine the appropriate location for your business, whether it is inside or outside a free zone.

- Submit a registration application with the relevant government agencies and follow the required procedures to obtain the necessary approvals.

What documents are required to open a commercial register in Dubai?

- Passport of the owner or legal officials.

- Photograph.

- A letter of approval from the owner to use the place as a business headquarters.

- Appointment letter to the CEO if necessary.

- Partners contract if the company is owned by several people.

How long does it take to open a commercial register in Dubai?

The time to complete the registration process varies depending on the type of activity and procedures required, but can take from approximately two weeks to two months.

What are the expected costs of opening a commercial registry in Dubai?

Costs vary depending on the type of activity, location and conditions required, but can be estimated at an amount ranging from several thousand to tens of thousands of UAE dirhams.

Do I have to be a UAE citizen to open a commercial register in Dubai?

No, foreign nationals can also open a commercial register in Dubai provided they comply with the applicable conditions and controls.

What are the differences between opening a commercial register in a free zone and in regular places in Dubai?

In free zones, there are facilities and privileges such as no local corporate taxes and 100% foreign ownership, while in normal places business activity is subject to local tax conditions and regulations.